Spencer Savings Bank: 130+ Years of Stability You Can Count On

Banks come and go, but Spencer is here for the long haul. While others shift, we remain your trusted financial partner—offering long-term stability, personalized service, and competitive financing solutions to help your business grow.

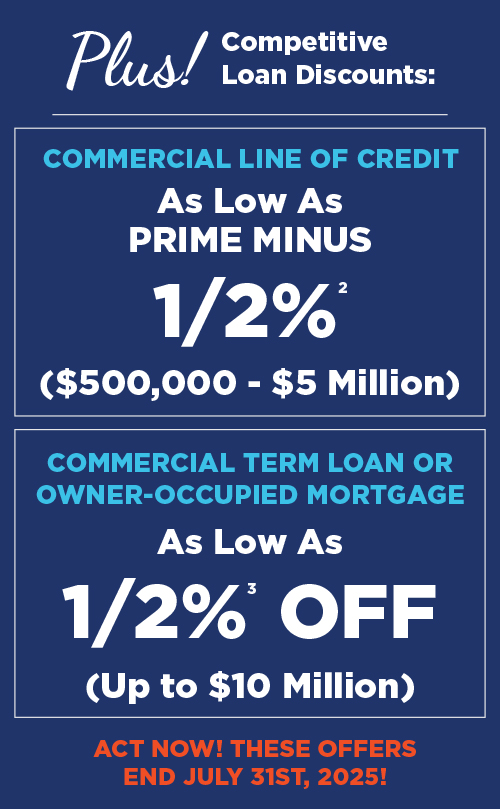

Limited-Time Offer for New Commercial Clients

We are offering an exclusive Commercial Banking Promotion to new clients:

Grow & Strengthen Your Business with Spencer

Whether you’re expanding, refinancing, or optimizing cash flow, Spencer delivers the powerful tools and expert support your business needs to thrive:

- Flexible Commercial Loans

- Competitive Rates

- Innovative Cash Management Solutions

- Personalized Services from a Bank that’s Here to Stay

Don’t Let Instability Disrupt Your Business

Partner with Spencer and experience the difference. Visit your nearest Financial Center or call today to speak with a Lending Specialist!

MaryRose Genovese

Senior Vice President, Director of Retail Sales & Service

mgenovese@spencersavings.com

1-973-766-4281

Sergio Musacchio

SVP, Director of Commercial & Industrial Lending and Small Business Finance

smusacchio@spencersavings.com

1-201-703-3827

Spencer refinances are not eligible for any of these loan promotions. Available to business entities that are physically located or licensed with the appropriate NJ or PA state or local governmental authority and operating with significant activities in NJ (“New Jersey Business”) or Bucks County, PA. Commercial loan financing is available for properties located in NJ, NYC Boroughs, and eastern PA. For both loan offers, an active commercial checking operating account with Spencer is required to receive the rate discounts. An active checking account is defined as an account that has multiple debits and credits coming in and out of the account monthly. There is a standard ½% Commitment Fee on all C&I Lending Lines of Credit, Term Loans or Owner-Occupied Commercial Mortgages. All loans are subject to credit approval. Other rates and terms available for borrowers that do not qualify for these promotional offers. Offers are only valid on loan applications submitted through July 31, 2025. Third-party data fees may apply. ¹Cash Management: Open any new Commercial Checking Account to qualify for six months of free Cash Management Services. Please note that service charges and transactional fees are associated with this product. For further details, refer to the Commercial Checking Account Terms and Conditions. Additionally, third-party fees, such as data carrier fees, may also apply. Services include monthly subscription charges for the following services: Remote Deposit Capture, Automatic Clearing House, Online Portal, Wire Modules, and Positive Pay Modules. Waivers are valid for new commercial checking clients enrolled by July 31, 2025, and are valid for 6 months following the account opening date. After 6 months, standard monthly charges will apply. ²Line of Credit: This offer is for a variable rate line of credit for amounts up to $5 Million. Rate as low as Prime minus 0.50% with a Floor Rate of 7.00%. As of April 30, 2025, the Prime Rate was 7.50% resulting in a promotional rate as low as 7.00%. Line of Credit interest rate is based on the total non-interest bearing deposit account relationship of the borrower(s) and guarantor(s). To qualify for this offer, the customer must keep compensating deposit balances averaging over a three-month period of 15% or greater of the loan amount. Upon annual renewal of this line of credit, the variable rate will be adjusted to reflect standard pricing in relation to total non-interest deposits. ³Term Loan/Commercial Mortgage: Term loans are fixed rate loans with terms ranging from 12 months to 60 months for loan amounts up to $10 Million. The borrower will receive up to a 0.50% rate reduction off current pricing. Commercial Mortgage must be owner-occupied to qualify. This offer is available on 5-year fixed loans with 25-year amortization, mortgage loan amounts up to $10 Million. To qualify for this offer, the customer must keep compensating deposit balances averaging over a three-month period of 15% or greater of the loan amount for the term loan.