Hurry! Grand Opening Exclusive Offers Await.

Offers are only valid through 6/29/24.

Limited Time Grand Opening Offers

Only available through June 29th, 2024

Visit our new Edison Financial Center, or call us at 732-702-8077 today!

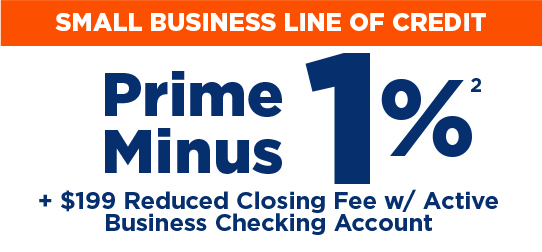

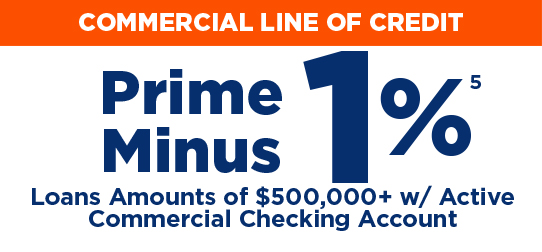

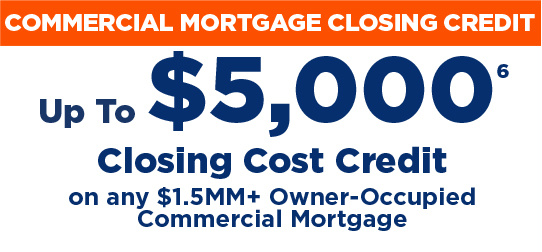

*APY=Annual Percentage Yield. Spencer refinances are not eligible for any of these loan promotions. Rates and terms are subject to change without notice. Other rates and terms available for borrowers that do not qualify for these promotional offers. All loans are subject to credit approval. 7New Money Only is defined as money not on deposit at Spencer Savings Bank. Available to business entities that are physically located or licensed with the appropriate NJ or PA state or local governmental authority and operating with significant activities in NJ (“New Jersey Business”) or Bucks County, PA. Commercial loan financing is available for properties located in NJ, NYC Boroughs, and eastern PA. All offers are only valid at the Edison Financial Center and new accounts must be opened or loan applications submitted by 6/29/2024 to qualify. APYs are accurate as of 4/01/2024. 1Cash Management Offer: Open any new Commercial Checking Account to qualify for six months of free Cash Management Services. Services include monthly subscription charges for the following services: Remote Deposit Capture, Automatic Clearing House, Online Portal, Wire Modules, and Positive Pay Modules. Waivers are valid for new commercial checking clients enrolled by 6/29/2024 and are valid for 6 months following the account opening date. After 6 months, standard monthly charges will apply. 2Small Business Line of Credit: This is a variable rate line of credit for line amounts up to $500,000. The line of credit interest rate is based on the total non-interest bearing deposit account relationship of the borrower(s) and guarantor(s) as well as the current Prime Rate as published in the Wall Street Journal. To qualify for this offer, the customer must keep compensating deposit balances averaged over a three-month period of 25% or greater of the loan amount. The rate can be as low as Prime Minus 1% with a Floor Rate of 7.50%. As of 4/01/2024 the Prime Rate was 8.50%, resulting in a promotional rate of 7.50%. There is a standard $500 Closing Fee on all Small Business Lines of Credit, which will be reduced to $199 for all new applications submitted during the promotional period. Upon annual renewal of this line of credit, the variable rate will be adjusted to reflect standard pricing in relation to total non-interest deposits. An active business operating checking account with Spencer is required to receive this promotional rate. An active checking account is defined as an account that has multiple debits and credits coming in and out of the account monthly. Other rates and terms available for borrowers that do not qualify for these promotional offers. 3Small Business Term Loan: Term loans are fixed rate loans with terms ranging from 12 months to 60 months for loan amounts up to $1,000,000. The borrower will receive a 0.25% rate reduction off current pricing. There is a standard $500 Closing Fee on all Small Business Term Loans, which will be waived for all new applications received during the promotional period. An active business operating checking account with Spencer is required to receive this promotional offer. An active checking account is defined as an account that has multiple debits and credits coming in and out of the account monthly. 4BusinessEdge Money Market: BusinessEdge Money Market is a variable rate, interest-bearing account with tiered interest rates as follow: Current Daily balances – Below $5,000 – No interest Earned, $5,000 – $9.999.99 – 0.25% APY, $10,000 or more – 3.25% APY. However, account openings with new money at the Edison Financial Center only during the promotional period will receive a 1.25% rate bump on daily balances of $10,000 or more, resulting in a promotional rate of 4.50% APY. This APY rate is guaranteed for 6 months after the account opening date. After 6 months, the APYs in all tiers may change. There is a $5,000 minimum to open this account. There is a monthly service charge of $15 if the daily minimum balance falls below $5,000 at any time during the statement cycle. Fees may reduce earnings on this account. 5Commercial Line of Credit: This is a variable rate line of credit for loan amounts greater than $500,000. The line of credit rate is based on the total non-interest deposit account relationship of the borrower(s) and guarantor(s) as well as the current Prime Rate as published in the Wall Street Journal. Rate can be as low as Prime Minus 1% with a Floor Rate of 7.50%. As of 4/01/2024 the Prime Rate was 8.50%, resulting in a promotional rate of 7.50%. To qualify for this offer, customer must keep compensating deposit balances averaged over a three-month period equal to 15% of the loan amount. An active commercial operating checking account with Spencer is required to receive this promotional offer. An active checking account is defined as an account that has multiple debits and credits coming in and out of the account monthly. Other rates and terms available for borrowers that do not qualify for these promotional offers. 6Commercial Mortgage Closing Credit: To qualify for this offer, there is a minimum loan amount of $1,500,000 on an owner-occupied mortgage requirement. Owner-occupied is defined as a property where >51% of the gross rentable space is occupied by the owner-operator and >51% of the cash flow to repay the debt is derived from the owner-operator business. Reimbursement under this offer of up to $5,000 closing credit will occur within 45 days of closing to the borrower’s Spencer commercial checking account. Reimbursement will be the lower of all approved closing costs paid by the borrower or $5,000, whichever is less. Eligible closing costs will consist of appraisal fees and review fees, environmental reports and review fees, SSB attorney fees, title insurance fees and miscellaneous fees including searches and recording fees. Other costs such as borrower’s attorney fees, property taxes, commitment fees and owner’s title insurance fees are not eligible for reimbursement.